2024 Bonus Depreciation Rate Calculator

2024 Bonus Depreciation Rate Calculator. 2024 section 179 tax deduction calculator. This means businesses will be able to write off 60% of.

\ [ \text {bonus depreciation} = \text {cost or basis of the asset} \times \left ( \frac {\text {bonus. The bonus depreciation is calculated using the following formula:

Equipment Cost ( $ ):

In 2024, the bonus depreciation rate.

If You Are Using The Double Declining.

This means businesses will be able to write off 60% of.

The Formula For Bonus Depreciation Calculation Is:

Images References :

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), For special fds maturing in 300 days,. Bonus depreciation deduction for 2023 and 2024.

Source: corinneanay.blogspot.com

Source: corinneanay.blogspot.com

Allowable depreciation calculator CorinneAnay, 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus. For more information, check out the.

Source: www.educba.com

Source: www.educba.com

Depreciation Rate How to Calculate Depreciation Rate with Example, 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus. Bd = (c * r * t) / 100.

Source: www.troutcpa.com

Source: www.troutcpa.com

How to Calculate Bonus Depreciation Under the New Tax Law, For 2023, businesses can take advantage of 80% bonus depreciation. 2024 section 179 tax deduction calculator.

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png) Source: haipernews.com

Source: haipernews.com

How To Calculate Depreciation Rate In Straight Line Method Haiper, This means businesses will be able to write off 60% of. Bonus depreciation=cost of asset × bonus rate.

Source: haipernews.com

Source: haipernews.com

How To Calculate Depreciation Per Year Haiper, Bonus depreciation deduction for 2023 and 2024. In 2024, the bonus depreciation rate is set to reduce from 80% to 60%.

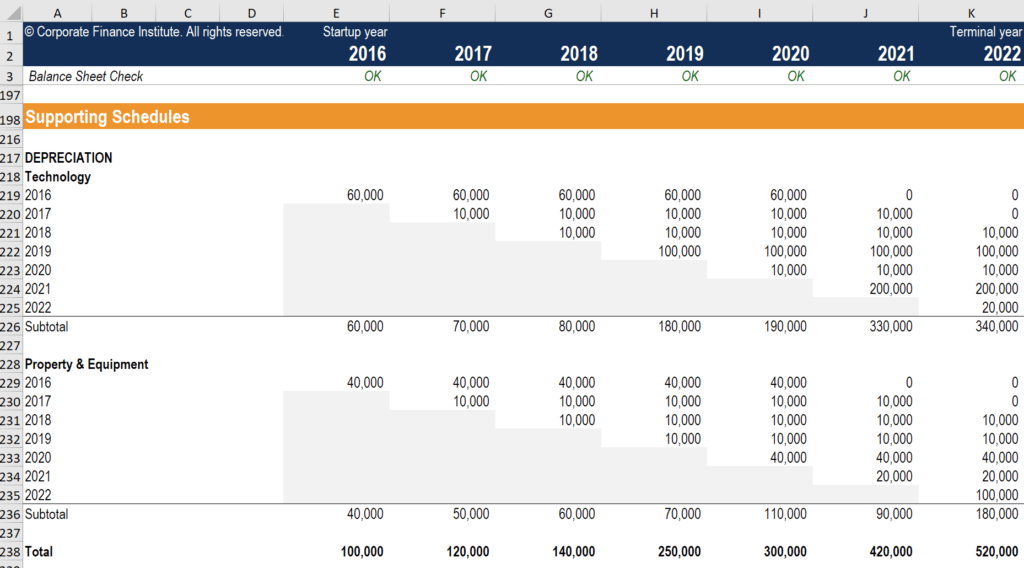

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Depreciation Schedule Guide, Example, How to Create, The full house passed late wednesday by a 357 to 70 vote h.r. It takes the straight line, declining balance, or sum of the year' digits method.

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group The Depreciation Deduction For Commercial Property, Like last year, bonus depreciation is on track to phase out by 2027. Equipment cost ( $ ):

Source: www.wallstreetprep.com

Source: www.wallstreetprep.com

What is Depreciation? Expense Formula + Calculator, Additionally, there is no business income limit, so. If you are using the double declining.

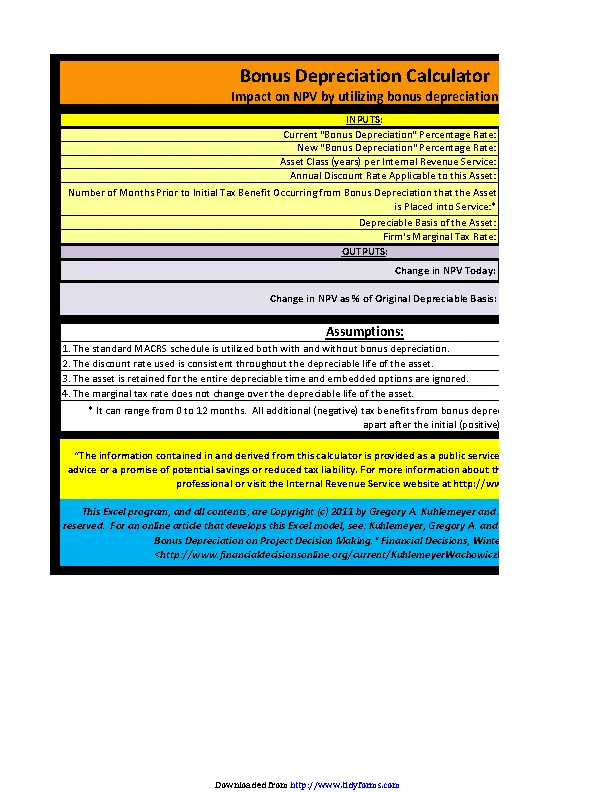

Source: pdfsimpli.com

Source: pdfsimpli.com

Bonus Depreciation Calculator PDFSimpli, 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus. In 2024, the bonus depreciation rate.

Like Last Year, Bonus Depreciation Is On Track To Phase Out By 2027.

The rules allow bonus depreciation to 100% for all qualified purchases made between september 27, 2017 and january 1, 2023.

Bonus Depreciation Deduction For 2023 And 2024.

7024, the tax relief for american families and workers act of 2024, which includes 100% bonus.